Salesforce Acquires Informatica to Create a New Platform for Agentic AI

On May 27, 2025, Salesforce announced its decision to acquire Informatica early in Salesforce’s fiscal year 2027. The planned acquisition is expected to enhance Salesforce’s data management foundation, which is critical for deploying responsible agentic AI.

Underlying reasons

Informatica developed a powerful knowledge graph (metadata system of intelligence) driven platform, which is essential for the integration and responsible use of AI agents. This is because it harmonizes the data, enables automated data quality and master data management, and provides common semantics for AI agents to communicate.

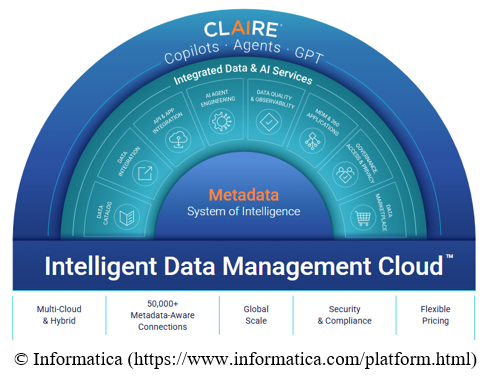

The platform – Intelligent Data Management Cloud (IDMC) – has all the necessary data management components: AI-powered data quality and master data management, and data integration and governance, with rich AI-readable metadata permeating and driving all components of the platform.

Market trend

Salesforce is not the only platform vendor who has recently enhanced its agentic AI capabilities by acquiring a knowledge-graph-based metadata management technology. On May 7, 2025, ServiceNow unveiled new Workflow Data Fabric capabilities, including a data ecosystem built to power AI agents and workflows with real‑time intelligence. Part of these new capabilities was acquisition of the data.world – a leading knowledge-graph-based metadata and governance management tool.

Possible impact on existing users

One of the first questions that sprang up right after the news about Informatica’s acquisition was the fate of MuleSoft (also owned by Salesforce). Although both platforms are often referred to as iPaaS, there seems to be a great difference between them: MuleSoft does not have any significant data management or governance capabilities, nor does it have rich metadata driving the platform. Although MuleSoft positions itself as “the open foundation to govern, orchestrate, and unlock the full potential of the multi-agent enterprise,” it lacks knowledge graph and data quality, augmentation, and governance capabilities. This could force Salesforce to either redefine MuleSoft’s value proposition, distancing it from the agentic AI platform or merge the two products.

As to what may happen to Informatica, one could infer by looking at other large Salesforce’s acquisitions, e.g. Tableau. Since Salesforce is dedicated to cloud, Informatica’s customers running on-prem PowerCenter may experience a strong push toward the cloud (similar to Tableau’s on-prem deployments push to the cloud).

Informatica’s R&D would likely be defined by Salesforce and skewed toward traditional Salesforce use cases, i.e. less focus on multicloud integration across different data repository vendors, more focus on sales-supporting capabilities.

Our Take

The main strength and value of IDMC seems to be its ability to connect various data repositories hosted on different clouds, e.g. Azure, AWS, GCP. If Salesforce starts driving Informatica’s clients solely into its own Data Cloud, the value of the platform may diminish for the customers who want to pursue multicloud strategy. Salesforce does promote Zero Copy Partner Network (ZCPN) and Informatica could contribute significantly into this ecosystem by enabling metadata and schema mapping or canonical model translation, data quality and master data management, data governance enforcement, and data lineage transparency, but there has not been any public announcement yet of Informatica’s involvement in ZCPN.

From the proverbial “shareholders’ perspective,” Salesforce gets access to Informatica’s large enterprise customers. Bundling products could become a strong sales strategy that would push Salesforce’s products to Informatica’s customers, as well as make Informatica’s products available to Salesforce’s medium-size enterprises. Such bidirectional expansion would help solidify and increase the overall market share.